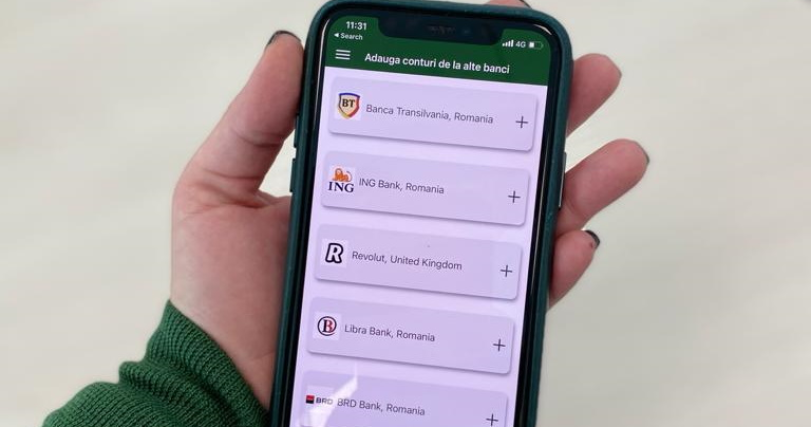

With the new implementation in the CEC Bank, project developed by ASEE (Asseco SEE) in cooperation with Finqware, all bank’s customers can view from now on, their accounts balances and transactions from 9 other top banks and financial institutions. The list includes the largest banks in Romania: Banca Transilvania, BCR, Raiffeisen, BRD, Unicredit Bank, ING, Libra Bank, Alpha Bank, but also Revolut.

“At Finqware we are true to our mission of putting open banking to work and improving the way people and companies manage their money. We are proud to work with CEC Bank as an innovation partner, powering open data consumption capabilities for the benefit of their customers. We are already working towards the next steps of our partnership, looking forward to implementing new PSD2 use-cases with the bank. Data-driven business optimization is our common long-term strategy, on top of consuming open banking”, declared Cosmin Cosma, Co-founder & CEO of Finqware.

The ASEE Mobile Banking application that is making all of these possible was upgraded with a new feature for CEC Bank mobile application, in order to provide the bank's customers the possibility to get account information from the banks previously mentioned. This will offer a seamless user journey, allowing authentication through the same screens and experience, the users have when accessing directly the other banks. With the aggregated accounts in the CEC Bank mobile application, the clients will be able to view them in a dedicated menu for accessing all accounts.

„The ASEE mobile application used by CEC Bank is constantly upgraded and improved with the most advanced features available in the financial digital market. This latest open banking functionality added is the perfect example of the cutting-edge drive that ASEE provides, making CEC Bank one of the digital transformation leaders on the local market, aggregating the largest number of accounts currently available. This is the result of the constant collaboration with the bank and its partners while understanding customer needs and setting technology trends for financial services”, stated Adrian Nastase, Country Leader ASEE (Asseco SEE) Romania.

CEC Bank, one of the largest retail banks in Romania, becomes one of the first banks to commercially launch features based on open banking in the CEE region.

In the Romanian market, the market leader Banca Transilvania launched a similar feature in its NEO platform in September 2020.

PSD2 regulatory framework makes it mandatory for the banks to open access to their own banking data through APIs, enabling secure connectivity and integration to any digital application. Romania becomes one of the few countries in the CEE region with two banking players driving open banking adoption in the local marketplace.

“Digitalization is an important pillar in CEC Bank’s strategy, and we are open to new technology that allows reliable, faster services and improved customer experience. Our omnichannel business model allows us to leverage our growth on both our brick-and-mortar network – the largest in Romania and new digital channels. With Finqware, we brought the multi-banking service from lab to market in record time, launching the feature in less than four months. We are working closely with our partner on extending open-banking features to payment initiation services”, stated Mugur Podaru, Digital Director, CEC Bank.

Finqware is a European technology company based in Romania that aims at putting open banking at work. Solving the complexities of open banking through its cloud multi-banking data infrastructure, the company aims to be a platform for innovation in FinTech, focusing on Central and Eastern Europe.